North begins his book by stating that "institutions are the rules of the game in a society or, more formally, are the humanly devised constraints that shape human interaction."(3) That being said North then proposes to examine... more

This report summarizes the results of a two-year study of the economic value of New Jersey's natural capital. Natural capital consists of those components of the natural environment that provide aa long-term stream of benefits to... more

This paper develops a new approach to the problem of testing the existence of a level relationship between a dependent variable and a set of regressors, when it is not known with certainty whether the underlying regressors are trend- or... more

Knowledge is a broad and abstract notion that has defined epistemological debate in western philosophy since the classical Greek era. In the past Alavi & Leidner/Knowledge Management

Practice expands and updates the ideas and concepts of the authors groundbreaking first book. Offering fresh innovations, strategies, and concise explanations of long-held theories, this book includes new alternatives for practitioners... more

The buzzword 'globalization' is used in many different ways to mean many different things. Inevitably, what are thought to be its discontents vary accordingly.

To JAMIE, WHO SET THE DEADLINE AND TO MARTY, WHO HELPED ME MEET IT Copyright © 1994, 1996 by the President and Fellows of Harvard College All rights reserved Printed in the United States of America First Harvard University Press paperback... more

This paper examines how recent econometric policy evaluation research on monetary policy rules can be applied in a practical policymaking environment. According to this research, good policy rules typically call for changes in the federal... more

Each copy of any part of a JSTOR transmission must contain the same copyright notice that appears on the screen or printed page of such transmission.

While the conventions for evaluating information systems case studies conducted according to the natural science model of social science are now widely accepted, this is not the case for interpretive field studies. A set of principles for... more

A Beginner's Guide to Structural Equation Modeling, second ed., 2004, Lawrence Erlbaum and Associates, Mahwah, NJ Is structural equation modeling (SEM) a mathematical Godsend or an instrument of the devil? Well respected researchers have... more

We examine the specification and power of tests based on performance-matched discretionary accruals, and make comparisons with tests using traditional discretionary accrual measures (e.g., Jones and modified-Jones models). Performance... more

This paper evaluates (1) whether the exogenous component of "nancial intermediary development in#uences economic growth and (2) whether cross-country di!erences in legal and accounting systems (e.g., creditor rights, contract enforcement,... more

This Paper Presents a Summary of Recent Work on a New Methodology to Test for the Presence of a Unit Root in Univariate Time Series Models. the Stochastic Framework Is Quite General. While the Dickey-Fuller Approach Accounts for ...

The user has requested enhancement of the downloaded file.

![Table II. Equilibrium correction form of the ARDL(6, 0, 5, 4, 5)

earnings equation

Notes: The regression is based on the conditional ECM given by (30)

using an ARDL(6, 0,5, 4,5) specification with dependent variable, Aw;

estimated over 1972ql-— 199744, and the equilibrium correction term

H%-1 is given in (31). R is the adjusted squared multiple correlation

coefficient, G is the standard error of the regression, AI and Bae are

Akaike’s and Schwarz’s Bayesian Information Criteria, xXbc (4), XF 2 (1),

x7 (2), and x20) denote chi-squared statistics to test for no residual

serial correlation, no functional form mis-specification, normal errors and

homoscedasticity respectively with p-values given in [-]. For details of

these diagnostic tests see Pesaran and Pesaran (1997, Ch. 18).](https://figures.academia-assets.com/46980930/table_011.jpg)

![This function also implausibly implies, as Pratt [17] and Arrow [1] have noted, that the insurance premiums which peo- ple would be willing to pay to hedge given risks rise progress- ively with wealth or income. For a related result, see Hicks (6, p. 802]. gs It is, consequently, very relevant to note that by using the Bienaymé-Tchebycheff inequality, Roy [19] has shown that investors operating on his “Safety First” principle (i.e. make risky in- vestments so as to minimize the upper bound of the probability that the realized outcome will fall below a pre-assigned “disaster level’) should maximize the ratio of the excess expected port- folio return (over the disaster level) to the standard deviation of the return on the port- folio?! — which is precisely our criterion of max 6 when his disaster level is equated to the risk- free rate r*. This result, of course, does not depend on multivariate normality, and uses a different argument and form of utility function. ML. Ci pee ntinea Mhaneneee nerdy 24n Onreweurlanwnn](https://figures.academia-assets.com/30555591/figure_001.jpg)

![The conclusions stated in the text are obvious from the graph of this case (which incidentally is formally identical to Hirschleifer’s treatment of the same case under certainty in [¥].)](https://figures.academia-assets.com/30555591/figure_002.jpg)

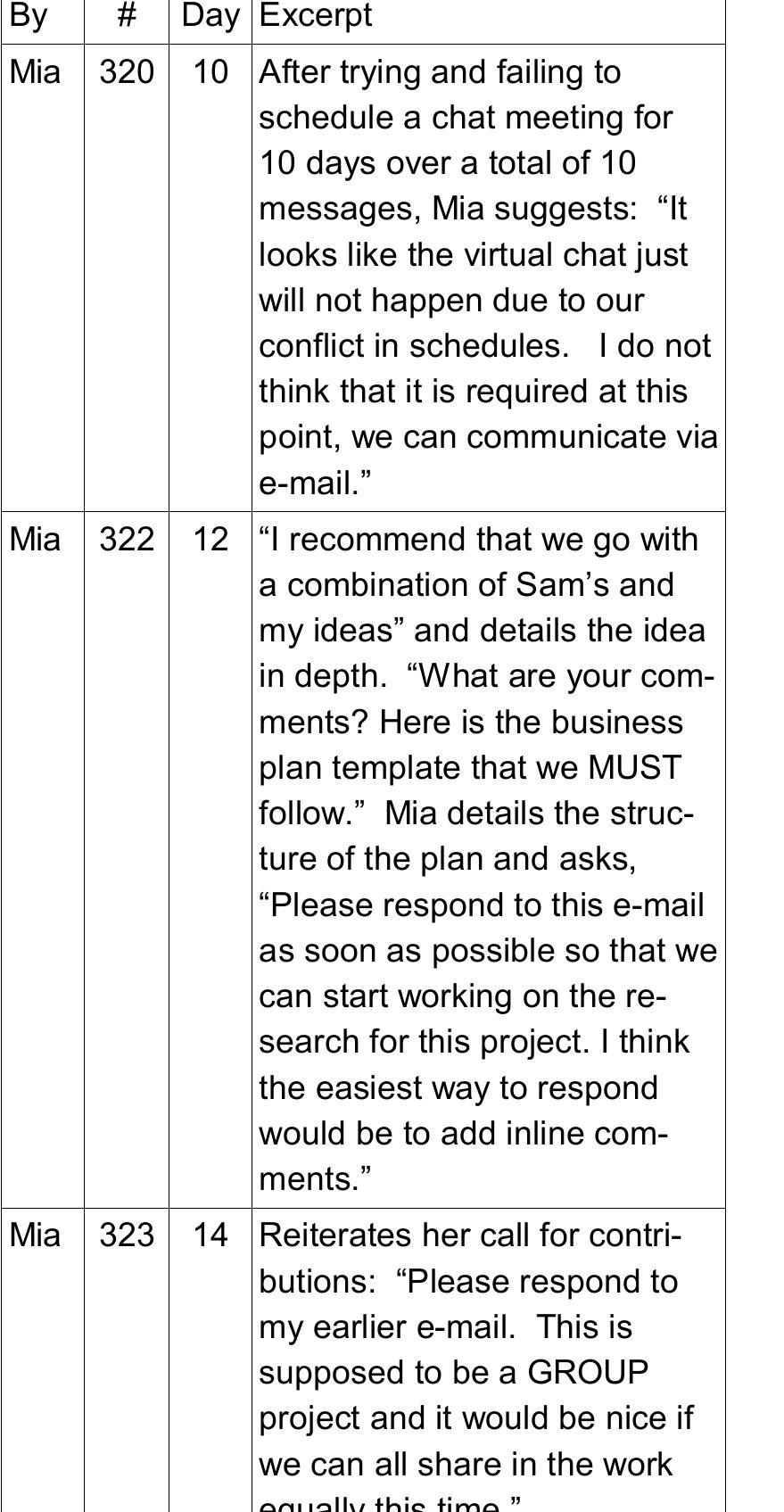

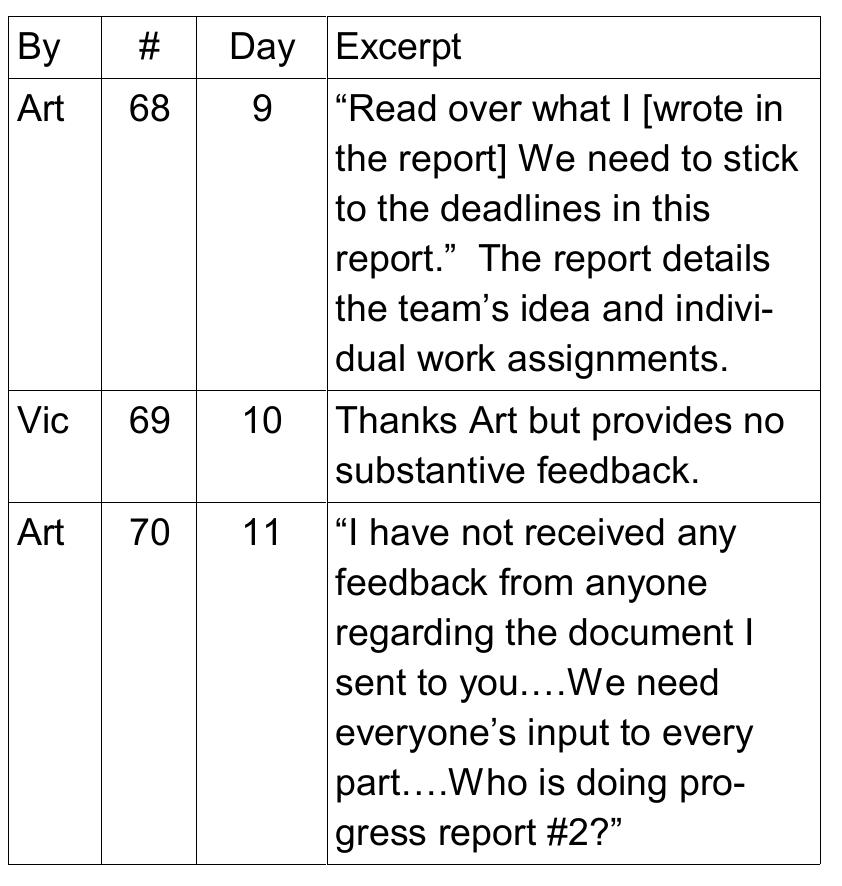

![As in Team 19T,,, this concern with deadlines leads to heightened vigilance and active moni- toring of teammates contributions by some members (e.g., “I have not received any feedback from anyone regarding the document | sent to you” [Art, 70]; “Ron, are you going to write the next progress reports?” [Art, 72; 74]; “Il checked the communication hub and there was no report so far submitted” [Ron, 90]).](https://figures.academia-assets.com/51339445/table_018.jpg)

![Summary of Predicted Signs Uncertainty Avoidance [Uncertainty Avoidance].](https://figures.academia-assets.com/10381602/table_003.jpg)

![“Total Accruals (TA,,) is defined as the change in non-cash current assets minus the change in current liabilities excluding the current portion of long-term debt minus depreciation and amortization [with reference to COMPUSTAT data items, TA = (AData4 — ADatal — AData5 + AData34 — Datal4)/lagged Data6]. Discretionary accruals from the Jones model are estimated for each industry and year as follows: TAj, = % + %/ASSETS;;-1 + #2ASALES;, +a3PPE;, + &i, where ASALES,, is change in sales scaled by lagged total assets and PPE;, is net property, plant and equipment scaled by lagged assets. Discretionary accruals from the modified-Jones model are estimated for each industry and year as for the Jones model except that the change in accounts receivable is subtracted from the change in sales. Discretionary accruals from the Jones Model (Modified-Jones model) with ROA are similar to the Jones Model (Modified-Jones model) except for the inclusion of current or lagged year’s ROA as an additional explanatory variable. For performance matched discretionary accruals, we match firms on ROA in period ¢ or t—1. To obtain a performance-matched Jones model discretionary accrual for firm i we subtract the Jones model discretionary accrual of the firm with the closest ROA that is in the same industry as firm i. A similar approach is used for the modified Jones aaa nAdal](https://figures.academia-assets.com/49093162/table_003.jpg)

![“Discretionary accruals from the Jones model are estimated for each industry and year as follows: TA;; = % + «;/ASSETS;;_; + #ASALES,;, + 03PPE;, + &, where TA;; is defined as the change in non-cash current assets minus the change in current liabilities excluding the current portion of long-term debt minus depreciation and amortization [with reference to COMPUSTAT data items, TA = (AData4 — ADatal — AData5 + AData34 — Data14)/ lagged Data6]. ASALES;, is change in sales scaled by lagged total assets (ASSETS; ;_1), and PPE;, is net property, plant and equipment scaled by ASSETS, ,_1. Discretionary accruals from the Jones Model (Modified-Jones Model) with ROA are similar to the Jones Model (Modified-Jones Model) except for the inclusion of current or lagged year’s ROA as an additional explanatory variable. For performance matched discretionary accruals, we match firms on ROA in period ¢t or t—1. To obtain a performance-matched Jones model discretionary accrual for firm i we subtract the Jones model discretionary accrual of the firm with the closest ROA that is in the same industry as firm i. A similar approach is used for the modified Jones model.](https://figures.academia-assets.com/49093162/table_012.jpg)

![“Discretionary accruals from the Jones model are estimated for each industry and year as follows: TA;; = % + «/ASSETS;;-1 + #ASALES,;; + a3PPE;, + &, where TA;, (Total Accruals) is defined as the change in non-cash current assets minus the change in current liabilities excluding the current portion of long-term debt minus depreciation and amortization [with reference to COMPUSTAT data items, TA = (AData4 — ADatal — AData5 AData34 — Data14)/lagged Data6], ASALES;, is change in sales scaled by lagged total assets (ASSETS;,_;), and PPE;, is net property, plant and equipment scaled by ASSETS,,_;. Discretionary accruals from the Jones Model (Modified-Jones Model) with ROA are similar to the Jones Model (Modified-Jones Model) except for the inclusion of current or lagged year’s ROA as an additional explanatory variable. For performance matched discretionary accruals, we match firms on ROA in period t or t—1. To obtain a performance-matched Jones model discretionary accrual for firm i we subtract the Jones model discretionary accrual of the firm with the closest ROA that is in the same industry as firm 7. A similar approach is used for the modified Jones model. Panel B. Ha: Accruals > 0* (Figures in bold (old italic) signify rejection rates that are significantly exceed (fall below) the 5% nominal significance level test and indicate that such tests are biased against (in favor of) the null hypothesis)](https://figures.academia-assets.com/49093162/table_007.jpg)